Governor Newsom has signed the Cal NORML-sponsored bill, AB 564 (Haney), to roll back the cannabis excise tax increase that happened on July 1 from 19% back to 15% on October 1, 2025.

Thanks to all Cal NORML’s supporters who helped lobby for the bill (including at our Lobby Day in March), and all who wrote letters via Cal NORML’s Action Network.

Support Cal NORML’s efforts to stop a tax increase in California by making a membership donation today! Business Memberships starting at $50 monthly include a directory listing and other perks.

Cal NORML focused on AB 564 at our March 24 Lobby Day in Sacramento, and has worked since then to secure necessary votes in favor of the bill in the Assembly and Senate. A pair of NORML Action Alerts, one pointing out the vast overtaxation of cannabis compared to comparable products, and a second pointing out that failed businesses don’t pay taxes, generated over 10,000 letters to lawmakers in support of the freezing taxes.

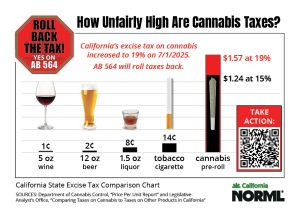

Cannabis Is Taxed At a Much Higher Rate Than Comparable Products

California raised its excise tax on cannabis from 15% to 19% on July 1, 2025.

Cannabis was already heavily over-taxed relative to comparable products like beer, wine, and tobacco in California.

The excise tax on one average, noninfused cannabis pre-roll is $1.24. In contrast, the excise tax on one glass of wine is $.01; a glass of beer $.02, a shot of liquor $.05-.08, and a tobacco cigarette $0.14. Adding in state sales tax and local taxes, cannabis products are taxed at a rate as as high as 38% (44% if delivered), and since taxes are compounded at the retail level, increasing the excise tax to 19% will increase the total tax to as much as 48%, roughly adding another $5 in taxes onto a $100 purchase, on top of the $38–$44 consumers are already being charged.

Cannabis taxes currently contribute more to California’s coffers than do alcohol taxes, despite far less sales. Gov. Newsom’s 2023/24 budget estimated an income of $440 million from alcohol taxes. By contrast, state excise taxes on cannabis brought in $624 million in 2023.

Any tax increase negatively impacts cannabis consumers and businesses in California.

Cannabis needs a tax decrease, not an increase. The California cannabis industry is struggling to compete against overtaxation, the illicit market, resistance to local licensing, and the proliferation of hemp-derived products. Medical marijuana patients in particular are unable to meet their needs for cannabis products under current pricing. Initial impacts of the July 1 cannabis tax increase can already be felt by businesses and consumers.

Failed Businesses Don’t Pay Taxes

California’s cannabis market has lost 30% of its active licenses in the past two years

Inactive cannabis licenses are climbing as California companies struggle to stay in business. Inactive licensees don’t make money, or pay taxes. Many of the inactive licenses are equity businesses, who are already facing a de facto tax increase as the vendor compensation program for cannabis equity businesses is set to expire on 12/31/25.

California’s licensed retail footprint has flatlined at roughly 1,225 active stores since mid-2023, as 57% of the state’s cities and counties still prohibit cannabis dispensaries, according to the California Department of Cannabis Control (DCC).

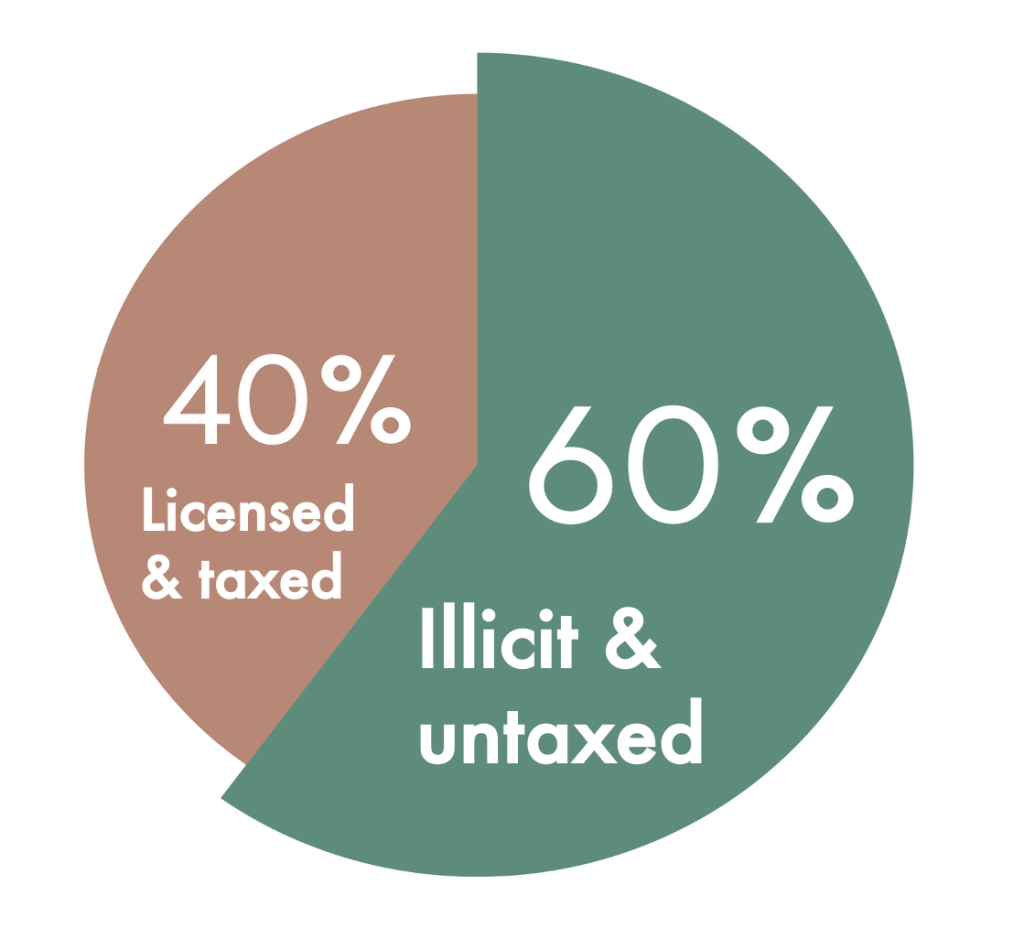

6 out of every 10 cannabis sales in CA is from the illicit, untaxed market

6 out of every 10 cannabis sales in CA is from the illicit, untaxed market

A new report from the CA Department of Cannabis Control estimates that total California cannabis consumption is 3.8 million pounds, and that only 1.4 million pounds is sold from the licensed market. This means the majority of cannabis sold in California is untaxed. High tax rates in the licensed market are a big reason consumers look elsewhere for their cannabis.

Total excise tax collected in calendar year 2024 was $593.6 million compared to $626 million in calendar year 2023. Cannabis tax revenues peaked in fiscal year 2021-22 at over $800 million.

Total cannabis tax revenue from the fourth quarter 2024 was $219 million, including $127.8 million in excise taxes and $91.2 in state sales tax, according to the CDTFA. This is down 13.7% from the total $253.8 million in the third quarter. The excise tax dropped 14.9% from $150.1 million.

California lost 17,600 cannabis jobs in the last two years

California led the nation with 12,600 cannabis jobs lost in 2023 and 5,000 cannabis jobs lost in 2024, according to industry employment agency Vangst.

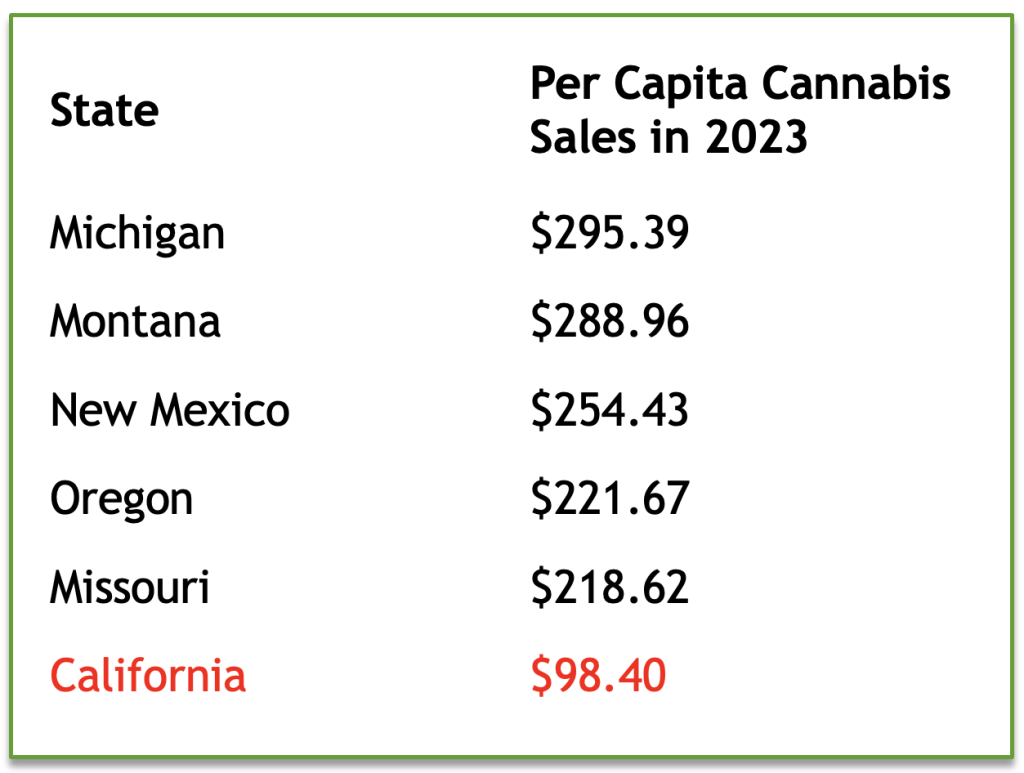

Other states with lower taxes outperform CA’s cannabis sales

Michigan, with its 10% state excise tax that is shared with local jurisdictions (which have no taxes of their own), is pointed to as a model for a successful roll-out of marijuana legalization. Missouri has a 6% state excise tax and caps local taxes at 3% (California has no such cap).

If California were on par in per capita sales with Michigan or Montana, it would be generating an estimated $13 billion in annual sales, and the state would be collecting substantially more tax revenue. Instead, the taxable sales for cannabis in 2024 was $4.6 billion. Source

Adding in state sales tax and local taxes, cannabis products are taxed at a rate as high as 38% (44% if delivered) in California. Since local taxes are compounded at the retail level, including packaging and service fees, increasing the excise tax to 19% will increase the total tax on cannabis to as much as 48%. This is far more than comparable products like beer, wine and cigarettes.

Please take action to support AB 564.

The Cannabis Tax Account Has a Budget Surplus

In fiscal year 2023-2024, the Cannabis Tax Account had a balance of $469.6 million and took in $629.4 million in taxes, according to the DCC’s Condition and Health of the Cannabis Industry in California supplemental report. But it spent only $560.5 million because legislators contributed $150 million from the general fund. For this fiscal year, estimated revenue is $603.7 million and expenditures are nearly $674.0 million, leaving a balance of $468.2 million.

For fiscal year 2025-26, the governor’s budget projects that cannabis tax revenues will be about $761.9 million, assuming the excise tax will increase to 19% on July 1. Expenditures are budgeted at only $610.2 million.

Who is Opposing a Cannabis Tax Freeze?

AB 564 is being opposed by groups that receive cannabis tax money for Youth Education Treatment and Prevention Programs, which have not been evaluated for their effectiveness, despite legislation requiring accountability.

In 2022, Governor Newsom signed AB 2925 (Cooper), requiring DHCS to provide to the Legislature by July 10, 2023 a spending report of funds from the Youth Education Prevention, Early Intervention and Treatment Account (YEPEITA) paid for by the Cannabis Tax Fund for the FY 2021–22 and 2022–23. In addition, the 2022 Budget Act stated that by March 1, 2023, and on the same date until 2025, the DOF shall submit a report to the Legislative Analyst’s Office, relevant policy committees, and the relevant budget committees of each house of the Legislature on Cannabis Tax Fund Spending.

Both AB 2925 and the 2022 Budget Act called for evaluations of YEPEITA programs, with AB 2925 stating: “The departments shall periodically evaluate the programs they are funding to determine the effectiveness of the programs.” Although DOF has provided some data in Budget Committee hearings about YEPEITA program expenditures, that data is incomplete, and no evaluations of the programs have been provided by DHCS.

Also see: Cal NORML-Sponsored Bill to Halt A Cannabis Tax Increase Passes First Committee

California Lawmakers Vote, 15-0, To Repeal Cannabis Excise Tax Increase