UPDATED 10/13/2025

Six cannabis-related bills made it through the legislature this year and four were signed into law, while ten failed to advance.

A bill from Asm. Haney to rollback cannabis taxes that Cal NORML sponsored became law, as did bills to regulate hemp from Asm. Aguiar-Curry and Sen. Wiener, and a bill from Asm. Ahrens to reduce the regulatory burden on cannabis research. The Governor vetoed a bill to expand local enforcement against cannabis, and a bill from Asm. Ahrens that Cal NORML support to allow microbusiness to ship certain cannabis products directly to patients.

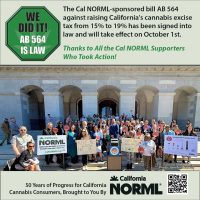

KEY BILL

AB 564 (Haney) – Cal NORML-sponsored bill to roll back the cannabis excise tax increase from 15% to 19% on October 1, 2025. As amended, the rollback is in effect until July 1, 2028. Signed into Law!

HEMP BILLS

AB 8 (Aguiar Curry) – intends to enhance the viability of cannabis licensees in the marketplace by pursuing measures to relieve tax and regulatory requirements, and to authorize licensees to manufacture, distribute, and sell hemp and cannabidiol (CBD) products in compliance with current law. Signed into law.

ENFORCEMENT BILLS

SB 378 (Wiener) – would impose strict liability for damages caused to the consumer on an online marketplace that facilitated the connection between a consumer and an unlicensed seller of a cannabis or intoxicating hemp product. Signed into law.

AB 632 (Hart) – would have authorized a local agency to file a final administrative order or decision for payment of fines or penalties related to unlicensed commercial cannabis activity for immediate judgment in the superior court of any county in California. The bill would also authorize a local agency to, by ordinance, establish a procedure to collect administrative fines or penalties by lien upon the parcel of land on which the unlicensed commercial cannabis activity occurred. Vetoed by the Governor, citing concerns about giving local governments more power to place liens on personal property.

MEDICAL BILLS

AB 1332 (Ahrens) – would authorize a licensed microbusiness with an M-license to directly ship medicinal cannabis to a patient in the state. Vetoed by the Governor, citing the cost for DCC to implement a new cannabis tracking system, and inviting supporters to resubmit a bill to meet patients’ needs.

AB-1103 (Ward) – Controlled substances: research. Would revise and recast provisions requiring the Research Advisory Panel to review research projects on Schedule I or Schedule II controlled substances. The bill was supported by Cal NORML and by the state Center for Medicinal Cannabis Research, whose research projects have suffered untoward delays due to RAP-C red tape. Signed into law.

BILLS THAT DID NOT ADVANCE OR BECAME TWO-YEAR BILLS:

AB-998 (Hadwick) – classifies cannabis vape pens, among others, confiscated at schools as household hazardous waste for disposal purposes. Held in Senate Appropriations.

AB 1496 (Blanca Rubio) – would reinstate the cannabis task force and expand it to include representatives from tribal governmental entities regulating commercial cannabis activity that opt to participate in the task force. Passed Assembly. First Senate hearing canceled at the request of author.

AB 1027 (Sharp-Collins, Hadwick) – Cannabis: testing: quality assurance. Would require a licensed testing laboratory to comply with a DCC request to evaluate the laboratory’s testing practice. Held in Senate Appropriations.

AB-686 (Berman) – Cannabis: appointees: prohibited activities. Ordered to inactive file.

AB-762 (Irwin, Wilson) – to prohibit disposable, battery-embedded vapor inhalation devices

SB 501 (Allen) – to put vape pens into the Plastic Pollution Prevention and Packaging Producer Responsibility Act, requiring manufacturers to ensure the safe and convenient collection and management of those products at no cost to consumers or local governments.

AB-1065 (Ortega) – to enact the Consumer Inflation Reduction and Tax Fairness Act, requiring that cannabis taxes and others not be included in calculating fees charged by credit card companies.

AB 1209 (Michelle Rodriguez) – to require an employer that is licensed or is required to be licensed under MAUCRSA annually to provide proof that it has secured payment of workers’ compensation.

AB 1397 (Flora) – to authorize a hemp manufacturer to produce and sell low-dose hemp drinks if they contain no greater than 0.5 milligrams of total THC per container, and are tested by an independent testing laboratory. It would prohibit a low-dose hemp drink from being sold to or consumed by an individual under 21 years of age and impose an excise tax of 10%.

SB 479 (Arreguin) – Cannabis: licensing: payment of goods and services.