As the California cannabis industry, already overburdened by overtaxation, faces a raise in the state excise tax from 15% to as much as 19% in 2025 in order to fund programs that benefit from cannabis taxes, a sizeable chunk of the Cannabis Tax Fund is being diverted into programs not mandated for funding by Prop. 64.

By Ellen Komp, Deputy Director, Cal NORML

Updated 12/6/2024

Also see: Help Cal NORML Fight for Fair Taxation of Cannabis in California

Proposition 64, the voter-approved measure that legalized the adult recreational use of cannabis in California in 2016, required taxes collected on state-licensed cannabis to be disbursed to a number of specific programs.

Proposition 64, the voter-approved measure that legalized the adult recreational use of cannabis in California in 2016, required taxes collected on state-licensed cannabis to be disbursed to a number of specific programs.

At issue in past and coming years is so-called “Tier-3” funding, which is to be disbursed as follows, via grant programs:

– 60% to Youth Education, Prevention, Early Intervention and Treatment

– 20% to Environmental Restoration and Protection

– 20% to State and Local Government Law Enforcement

Prop. 64’s cannabis tax funding mandates are enshrined until 2028, when some changes can be made, but only if they don’t reduce the amount of Tier 3 funding mandated in the measure.

Cannabis Tax Reform Efforts

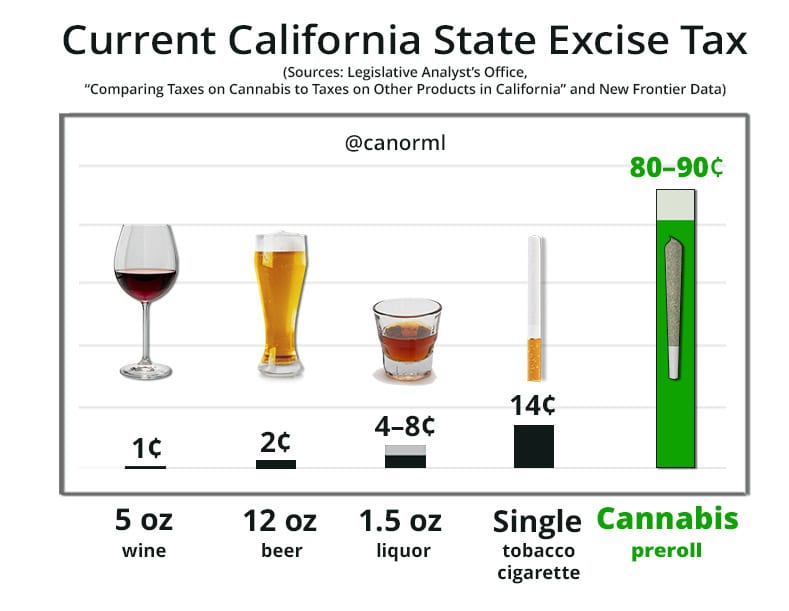

Cal NORML and other groups have been working for years to reduce the tax burden on cannabis businesses in California, currently at 15% state excise tax, plus state sales tax and oftentimes, “special” local taxes on top, bringing total taxes as high as 40% and much higher than taxes on comparable and more dangerous consumer goods like alcohol or cigarettes.

The state excise tax on a bottle of wine is 4 cents. The state excise tax on an ⅛ ounce of cannabis is $4.90 or over 100 times more. At Cal NORML, we witnessed a mass exodus from the legal medical marijuana market back to the well-established illicit one just after Prop. 64 taxes took effect in 2018. “Pop up” sales of unlicensed and untested products lead to the only instances of cannabis products known to cause deaths during the EVALI crisis of 2019.

California is falling short of other states in per capital cannabis sales:

| State | Per Capita Cannabis Sales in 2023 |

| Michigan | $295.39 |

| Montana | $288.96 |

| New Mexico | $254.43 |

| Oregon | $221.67 |

| Missouri | $218.62 |

| California | $98.40 |

Source: https://www.cannabisbusinesstimes.com/news/state-cannabis-sales-trends-august-2023/

Michigan, with its 10% state excise tax that is shared with local jurisdictions (which have no taxes of their own), is pointed to as a model for a successful roll-out of marijuana legalization. Missouri has a 6% state excise tax and caps local taxes at 3% (California has no such cap). Oregon with its 17% state excise tax, plus up to 3% local taxes in a state with no sales tax on any other product, has seen business failures; their numbers are boosted by sales from customers from bordering states without legal cannabis. If California were on par in per capita sales with Michigan or Montana, it would be generating $13 billion in annual sales, and the state would be collecting substantially more tax revenue, concludes Cal NORML board member Hirsh Jain of Ananda Strategy.

Some measure of tax reform was gained in California with the 2022 budget bill AB 195, which eliminated the cannabis cultivation tax but requires an analysis by May 1, 2025 to potentially adjust the excise tax on July 1, 2024 to as much as 19% to cover the estimated amount that would have been collected in the previous fiscal year via the cultivation tax. An agreement was reached with the Governor and Legislature to set a bar of $670 million for Tier 3 programs funded by cannabis taxes to avoid a tax increase.

Reform groups and tax recipients are gearing up for a battle on taxation in the coming years, and it’s already begun. In February 2024, 56 groups receiving cannabis tax monies sent a letter to the legislature asking them to raise the cannabis excise tax or re-instate the cultivation tax in 2025. Meanwhile, little noticed is the fact that the bulk of the 60% cannabis tax allotment for youth education and prevention programs has been diverted to pay for child care, something not mandated by Prop. 64 or approved by California voters.

How Cannabis Tax Funds Have Been Misdirected

Governor Newsom’s budget proposal for 2019 directed, after $12 million to the Department of Public Health for cannabis “surveillance and education activities,” a whopping 75% ($80.5 million) of the 60% of cannabis tax funds earmarked for education, prevention, and treatment of youth substance use disorders to “subsidize child care for school-aged children of income-eligible families.”

Only a remaining 20 percent ($21.5 million) was directed to the Department of Health Care Services for “competitive grants to develop and implement new youth programs in the areas of education, prevention and treatment of substance use disorders along with preventing harm from substance use.” The remaining 5 percent ($5.3 million) was earmarked for the California Natural Resources Agency to support youth community access grants.

Reporter Brooke Staggs explained in a 2019 Orange County Register article how surprising it was that Prop. 64 tax funding was being directed away away from after-school programs and into child care. The article states:

When Prop. 64 was approved by voters, officials projected more than $1 billion a year would come to the state in new cannabis-related revenue, and at least some of that would be directed for after-school programs for lower-income families.

Now, 19 months later, the numbers are very different. Cannabis has generated much less than projected in sales taxes, and after school programs haven’t seen a single dollar from legalized marijuana.

In May, Gov. Gavin Newsom, who campaigned as a supporter of both Prop. 64 and expanded after school programs, surprised many insiders when he opted to dedicate $80.5 million in cannabis taxes available this fiscal year — plus $130.5 million expected to be available each year going forward — to finance vouchers for child care, money that would go to more than 11,000 families in need. His administration says giving parents vouchers offers more flexibility than direct funding for After School Education and Safety (ASES) programs, because the vouchers can be used by parents who work non-traditional work schedules.

Supporters of ASES have nothing but praise for the programs. But many also said Newsom’s move amounted to a “bait and switch” for voters, who were told marijuana tax revenue would specifically support “after school programs,” which poll consistently higher with voters of all demographics than “subsidized child care.”

After school programs are also backed by data that show students who participate are less likely to use drugs or become victims of crime and more likely to do better in school. Supporters argue that those results align with the mission of Prop. 64 funding.

In 2019 Assemblymember Kevin McCarty (D-Sacramento) authored a bill, Assembly Bill 1085, to redirect cannabis tax revenue to ASES programs and federally funded 21st Century Community Learning Centers, which offer after school programs for high school students. McCarty’s bill passed through the legislature but was vetoed by Newsom.

The legislature has fallen in line with the Governor’s suggestion on funding child care with cannabis taxes in subsequent years. This year’s budget bill also contains an allotment of $601,000 to support the State Department of Public Health and $1,801,000 for the Dept. of Food and Agriculture.

Source: https://abgt.assembly.ca.gov/system/files/2024-03/sub-5-march-12-agenda-final.pdf (p. 13)

Grantees Lead the Charge Against Cannabis Tax Reform

At the November 16, 2023 meeting of the Department of Health Care Services (DHCS) Prop. 64 advisory group, whose purpose in part is to provide feedback on Youth Education, Prevention, Early Intervention and Treatment Account (YEPEITA)-funded programs, Lynn Silver of the Oakland-based Public Health Institute (PHI), who is on the board of the group, made a pitch for all of the groups present to lobby against tax reductions for cannabis, since they are funded by those taxes. Silver acknowledged at the meeting that the bulk of the funding was going to education, not to YEPEITA programs. Her group continually uses the need for child care funding as a reason to keep cannabis taxes high.

PHI took the lead on a letter sent by various groups last week to legislative leadership proposing increasing the cannabis excise tax and/or re-instituting the cultivation tax in order to ensure that Tier 3 funding continues at needed levels. Their rallying cry has been picked up by the San Francisco Chronicle, among other outlets.

Arguably PHI’s activities have crippled the California cannabis market at the local level, where still over half of the state’s municipalities don’t license cannabis businesses. The Oakland-based group has contacted every city and county in California, encouraging them to pass restrictive measures with high local taxes, levied on top of the state excise tax. Their “Getting It Right from the Start” project has released its fifth annual scorecard of California’s cities and counties, ranking localities according to how well they limit the number of legal cannabis retail outlets, how high they tax cannabis, and whether they ban cannabis at events and lounges.

The institute is funded by the Conrad N. Hilton Foundation, the National Institute on Drug Abuse (NIDA), and the CA Tobacco-Related Disease Research Program (which arguably has no business addressing cannabis). PHI also received $443K between 2021 and 2024 from Prop. 64 grants via the city of Oakland. PHI’s director Silver testified last year against a bill, SB 512 (Bradford), that would have ended double taxation on cannabis, since local taxes are currently included in the gross receipts total that must pay the 15% excise tax (as a new video from CDTFA jauntily reminds retailers). That bill failed, but Sen. Bradford has introduced another bill this year, SB 1059, to fix the problem somewhat without reducing state excise taxation. (UPDATE: That bill did pass.)

Hearing Reveals Budget Surplus of $260 Million in Tier 3 Fund

Source: https://abgt.assembly.ca.gov/system/files/2024-03/sub-5-march-12-agenda-final.pdf (p. 11)

At a March 12 hearing of the Assembly Budget Subcommittee #5, representatives from the Legislative Analyst’s Office (LAO) and (Department of Finance) DOF said they expect future tax revenues will just about meet their $670 million mark in coming years, though they seemed to think the excise tax would be automatically adjusted up per AB 195.

Katie Howard from Board of State and Community Corrections (BSCC) testified that not all grant monies were being distributed to cities and counties for law enforcement activities, since there were not enough applicants for the grants. Under Prop. 64, only local jurisdictions that license cannabis businesses can apply for the grants, as an incentive for locals to license. A pending two-year bill from Assemblymember Lackey, AB 1616, would open grants up to cities and counties that have not licensed, but so far has stalled in the legislature over conflicts with Prop. 64.

Some $260 million in unspent funds have accumulated in the Tier 3 law enforcement account, and those funds are being used on loan to backfill deficits in the Tier 3 accounts, to the tune of $100 million a year, proposed to be paid back by $50 million in 2026-27 and the remaining $50 million 2027-28.

Asked by Committee member Christopher Ward if cannabis tax funds overlapped with other general-fund-supported programs, Andrew Hoang of DOF replied that DSS (Dept. of Social Services) provides childcare funding but, “the department is looking to utilize that Prop. 64 excess for child care,” referring to dollars already provided to DSS in previous years and the estimated allocation of $247 million in 2024-25 to fund child care slots. Because DSS prioritized using Federal COVID-19 relief funds for 2021-22, 2022-23 and 2023-24 to support its CAPP and CCTR childcare programs, the department had a lower utilization of Proposition 64 funds within those years and also has a surplus of $357 million.

So, it seems that even more cannabis tax funds could be going to child care, even though that funding stream was not approved by the voters in Prop. 64, not all cannabis tax funds are being used, and the cannabis industry continues to struggle to bring in adequate tax revenue in a scheme that already overtaxes their product, and may increase taxes very soon.

Conclusions

In 2022, Governor Newsom signed AB 2925 (Cooper), requiring DHCS to provide to the Legislature a spending report of funds from the YEPEITA paid for by the Cannabis Tax Fund for the 2021–22 and 2022–23 fiscal years by July 10, 2023. Cal NORML requested this report from DHCS, who referred us to DOF. They supplied us with the same report they sent to the Budget subcommittee, as required by the 2022 Budget Act, which states:

(L) The departments shall periodically evaluate the programs they are funding to determine the effectiveness of the programs.