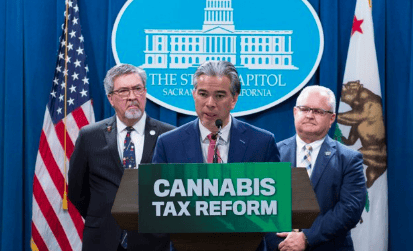

January 21, 2020 – For the third year in a row, a bill has been to lower taxes on licensed cannabis products in California. Announced at a press conference by Asm. Rob Bonta (D-Alameda) along with co-sponsors Ken Cooley (D-Rancho Cordova) and Tom Lackey (R-Palmdale), the bill (AB 1948) seeks to eliminate cultivation taxes for three years, and lower the state excise tax from 15% to 11% during that period.

January 21, 2020 – For the third year in a row, a bill has been to lower taxes on licensed cannabis products in California. Announced at a press conference by Asm. Rob Bonta (D-Alameda) along with co-sponsors Ken Cooley (D-Rancho Cordova) and Tom Lackey (R-Palmdale), the bill (AB 1948) seeks to eliminate cultivation taxes for three years, and lower the state excise tax from 15% to 11% during that period.

“We’re confident we’re going to get something done this year, because the industry has been patient enough,” said Asm. Lackey, mentioning that a number of vaping-related illnesses and deaths that have happened in California due to the availability of illicit cannabis products.

State Treasurer Fiona Ma and co-sponsors Reggie Jones-Sawyer (D-Los Angeles) and Mark Stone (D-Santa Barbara) also support AB 1948. “This bill is needed to help cannabis businesses transition into the marketplace, just like we would for any startup industry,” said Ma.

Last year’s tax-reduction bill AB 286 was held up pending a newly released Legislative Analyst’s Office report that called for revamping the state’s cannabis tax system, possibly moving to a dosage-based tax. The report used 11% as a possible tax rate, finding that while it could lower tax revenue in the short term, it would be helpful in helping licensed retailers compete against the underground market.

“I was pleased to see the report recommended eliminating the cultivation tax as we call for in AB 1948,” Bonta said. “We must lower and simplify the taxes on cannabis if the regulated cannabis industry in California is to survive, let alone thrive.” He pointed to Washington and Oregon, states that lowered their tax rate and were ultimately able to improve their tax income by encouraging more people to buy their cannabis from legal sellers.

Gov. Gavin Newsom signaled in his proposed 2020-21 budget that he is open to cannabis tax changes, including basing the excise tax on average selling price instead of estimated markup, meaning retailers will no longer have to pre-pay excise tax to distributors. Newsom’s office plans to release a draft trailer bill on February 1 with some of his proposed changes. The Governor will also “consider other changes to the existing cannabis tax structure, including the number of taxes and tax rates to simplify the system and to support a stronger, safer legal cannabis market.”

Newsom’s budget proposal also includes an extra $15 million for local equity programs. Another report, on nonprofit cannabis businesses, has been sent for review to the state Bureau of Cannabis Control, which will be releasing it soon.

Cal NORML will be tracking AB 1948 and other California bills as they are assigned to legislative committees, and alerting our supporters when it is time to contact your lawmakers to take action. Sign up for Cal NORML’s email alert list.

Also see: Cal NORML Denounces Cannabis Tax Hike

LA Weekly: State Legislators Target Pot Taxes with AB 1948

OC Register: Cut Taxes on the Legal Marijuana Market, Pass AB 1948

LA Times: California lawmakers say pot taxes must be cut to help an industry ‘on the brink’

Eureka Times Standard: Proposed cannabis tax reforms would benefit locals, industry says