The page you are looking for doesn't seem to exist. Here is information that may help you find what you need.

Recent News

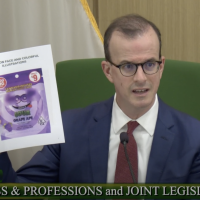

CA Lawmakers Hold Hearing on Cannabis Packaging

A “joint” hearing of the CA Joint Legislative Audit and Asm. Business and Professions Committee was held in Sacramento on February 17 addressing cannabis packaging and its attractiveness to children. Chair of the Joint Legislative Audit

California Cannabis Bills for 2026

Several cannabis bills have been introduced in the California legislature, many of them on the deadline of February 20. Cal NORML will be tracking the following: AB 1826 (Lackey) Cannabis: recall, embargo, and destruction of cannabis

Have You Been Discriminated Against by A Kaiser Permanente Doctor for Using Cannabis? Join Cal NORML’s Action Demanding Kaiser Change Its Policy.

California NORML and our supporters worked hard in 2022 to sponsor and pass AB 1954, to protect medical marijuana patients against discrimination by their doctors. This was in response to numerous complaints we received from patients, particularly those

Medical Marijuana Shipping Bill Scrapped

UPDATE 2/26/26 – The cannabis language in the bill has been erased, following opposition from some in the cannabis industry, concerned that it would open the door to broader shipping. UPDATE 2/20/26 – During a chat

Disposable Vape Ban Bill Amended to Remove Cannabis Vapes

UPDATE 1/26/2026: Asm. Irwin’s bill to ban disposable vapes passed in the Assembly Appropriations committee and was headed for a floor vote when it was amended to remove cannabis vapes from the language. Cal NORML favors shifting